georgia film tax credit history

The agent name for this entity is. Many are unaware of this but Georgia is known as the Hollywood of the South because of all the film productions which choose the state as the location of choice.

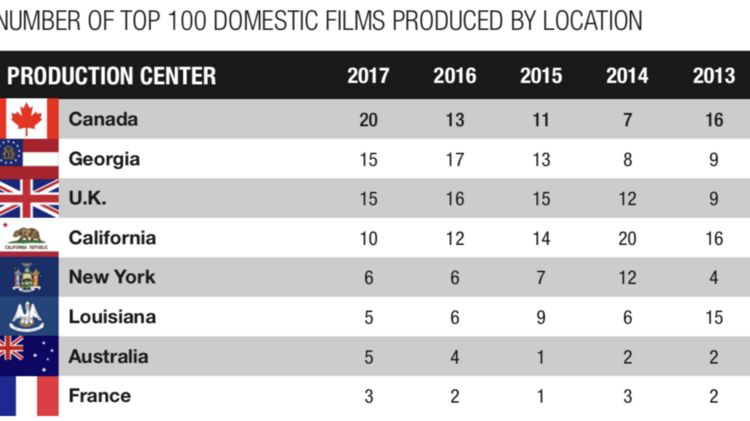

More than 3 billion in credits were generated from 2013-2017 with the amount increasing each year.

. At one time 44 states offered a film tax incentive. Minnesota Hawaii and Missouri were the second third and fourth states to pass a tax credit program for the film industry in the late 90s. This audit evaluated the extent to which production companies that.

In 2011 Louisiana hosted over 150 productions with an attributed 13 billion in film industry-related revenues to the state. The film industry in Georgia is the largest among the states of the United States for production of feature films by number of films produced. The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to the subsequent tax year.

Projects first certified by DECD on or after 1121 with. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit. Direct contact for an audit inquiry.

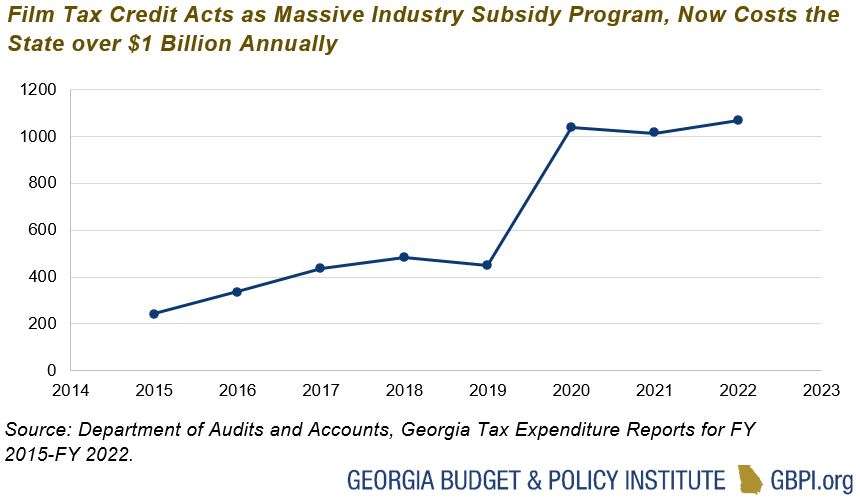

The film tax credit is Georgias largest tax credit. The state grants an additional 10 tax credit if the finished project includes a promotional logo provided by the state. Important Changes to the Georgia Film Tax Credit.

Certification must be applied for within 90 days of. Taxpayers have the ability to purchase these credits retroactively for up to three years. For services performed in Georgia.

About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions. Although Georgia provides an incredible Georgia film tax credit the pairing of both the state of Georgia and EUE Screen Gems makes for top quality productions with a low bearing cost making the 2 a great deal found. In fact according to the Georgia Department of Economic Development there was a new record set last year with 399.

Includes a promotional logo provided by the state. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule.

Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. Georgia Department of Revenue. This 50000 would apply to current year or prior year taxes owed and any remaining amount.

In 2016 more than 667 million in film tax credits were generated with the amount growing to more than 915 million in 2017. This is perhaps the easiest way to reduce your Georgia tax liability. 1800 Century Blvd NE Suite 18104Atlanta Georgia 30345.

I write this report to provide an accurate and objective analysis of Georgias film tax credit program and its effect on the states economy. EUE Screen Gems offers a 6 decade history of making film television and also commercial projects of the best quality. A Base Certification Application may be submitted within 90 days of the start of principal photography.

If the production company pays an individual for services as a loan-out a personal. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax. The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified.

Georgias Entertainment Industry Investment Act provides a 20 tax credit for filming and entertainment industries that spend 500000 or more on production and post-production either on single or multiple projects. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. Georgias film industry contributes approximately 3 billion of Georgias 588 billion GDP which represent 05 percent or 1200.

Certification for live action projects will be through the Georgia Film Office. Under the act the Georgia movie tax credit is available to both Georgia residents and non-residents. Most of the credits are purchase for 87-92 of their face value.

This is an easy way to reduce your Georgia tax liability. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages. Tax The Georgia film credit can offset Georgia state income tax.

Of the film tax credit 18-03A was released earlier this month. An additional 10 tax credit was awarded. An additional 10 credit can be obtained if the finished project.

My general findings are as follows. Companies for services performed in Georgia when getting the Georgia Film Tax Credit. September 8 2020.

The verification reviews will be done on a first comefirst serve basis. The 500 of withholding would be eligible for a refund. Certification for live action projects will be through the Georgia Film Office.

CBS46 - A big development today in the effort to limit Georgias tax credit for the film industry. There is a salary cap of 500000 per person per production when the employee is paid by salary which is defined by the Georgia film incentives website as being paid with a W2. Withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees.

The income bill passed. The Georgia Entertainment Industry Investment Act provides the largest tax credit offered by Georgia and it is the most generous film incentive program in the nation with an estimated 915. The company id for this entity is 12016630.

Click to learn additional information and to obtain the GDORs application form. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. 20 base transferable tax credit.

The act granted qualified productions a transferable income tax credit of 20 of all in-state costs for film and television investments of 500000 or more. GEORGIA FILM TAX CREDIT FUND LLC was registered on Feb 23 2012 as a domestic limited liability company type with the address 3333 Piedmont Road Suite 2500 Atlanta GA 30305. 6 GEORGIA FILM CERTIFICATION PROCESS FOR THE 20 PERCENT GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 transferable tax credit the Georgia Department of Economic Development must certify the project.

The entitys status is Active now. For more information on. So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there value that would equal 44500.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

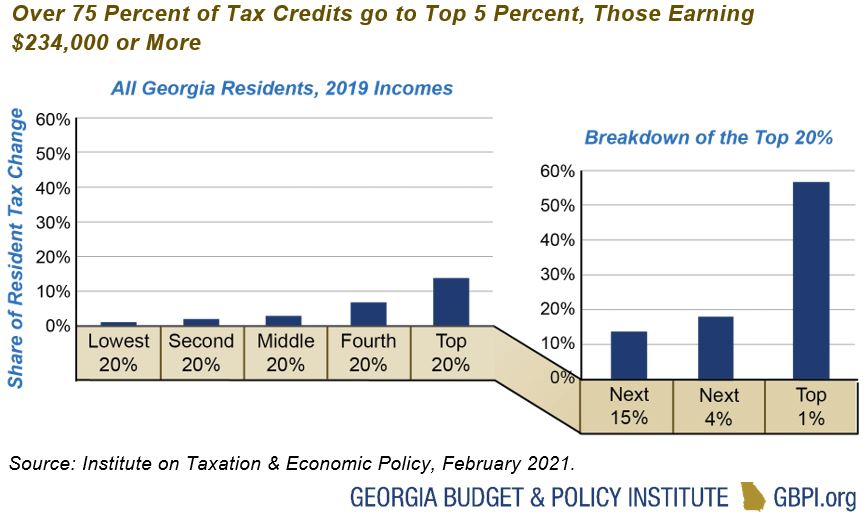

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Film Tax Credit Could Be Capped Amid Fiscal Crisis Variety

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

The Bowery Went Down To Georgia Georgia Film Savannah Chat

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Essential Guide Georgia Film Tax Credits Wrapbook

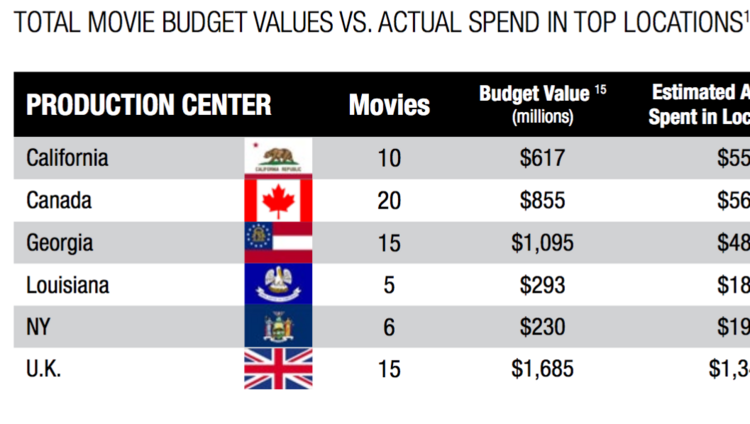

Industry S Most Competitive Incentives Lure Top Production Companies To Georgia Georgia Department Of Economic Development

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

The Surveyed Films Represent 7 6 Billion In Direct Spending And Tens Of Thousands Of Jobs In An Array Of Professions California California Movie Film School

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle